Sales breakthroughs have a lot to do with your ability to be comfortable with being uncomfortable.

In many situations, success comes from understanding how to turn present discomfort into future gain. Many of the actions that aren't enjoyable now , such as making cold calls or working after hours when you feel like stopping but know you need to finish , are necessary to add value to each new step you take.

Here are some thoughts to keep you motivated when the going gets tough.

HARD WORK NOW WILL PAY OFF LATER

All the sales you've ever made did not happen overnight. They were likely accounts you worked on for long periods of time. Everything you have today was brought forth by all your past efforts. Think about what you've accomplished by doing the things you didn't want to do.

LEARN FROM EVERY EXPERIENCE

Understand and appreciate that the upside of difficulty is that there will always be new opportunities for learning and improving your skills.

FOCUS ON THE POSITIVES

Find something unique about each contact you encounter during the day to make something you might not enjoy enjoyable. Once I was making phone calls to new companies shortly after a snowstorm, and I found it to be a great time to make calls. You'd be surprised at how many people were in pleasant moods. On one call, I was speaking with the assistant to the vice president of sales, and she said she loved the sight of the snow outside her window. She was in a great mood and was very helpful. Following the call, I sent her a nice handwritten note about our brief talk and thanked her for her time. This won't close a sale, but it builds your chances of standing out in a positive way as you move forward with your next steps.

PICK A DIFFICULT ACTION OVER THE EASY ONE

Doing so will make you grow stronger as a person, not just as a salesperson. Call on the bigger accounts, start at the top and sell your way down and across departments, and make the calls after you're ready to go home. In the long run, this is what will separate you from the average performer.

TRY A DIFFERENT TECHNIQUE

A good friend of mine told me that he takes cold showers every day and rarely gets sick. Right after a hot shower, he turns off all the hot water and lets the shower run down his spine and all his joints. Does it feel uncomfortable at first? Yes. Does it shock your body? Yes, but then something strange happens. After a few weeks, your body becomes warm after a few seconds of the pain. Eventually, you begin to look forward to it. What was once uncomfortable is now comfortable. There's no difference between this and making uncomfortable calls to new people or making a presentation to a large group. In the beginning, it's difficult and uncomfortable, but later it becomes easier and produces rewarding results. I've been taking cold showers for more than four years now and have not gotten sick since.

Monday, July 30, 2007

Friday, July 27, 2007

YOUNG ENTREPRENEURS

Ben Kaufman

Age: 20

Location: Burlington, Vt.

2006 Revenue: $1 million

Employees: 14

Year founded: 2005

What it does: Mophie makes cases, splitters, arms band, and clips for the iPod. The iPod accessory market may be crowded these days, but Kaufman's goal is to turn Mophie into a community-based product-development company that will solicit ideas for all kinds of new products -- not just iPod add-ons -- from a 50,000 member online user base. He's got $2 million in venture capital and a former top exec from Burton Snowboard on board to help him do it. Revenue is expected to hit $5 million this year.

Sean Belnick

Age: 20

Location: Kennesaw, Ga.

2006 Revenue: $24 million

Employees: 75

Year founded: 2001

What it does: At 14, Sean Belnick started a direct-shipping company for office furniture from his bedroom -- with $500. The company now stocks many of the products it sells in a new 327,000-square-foot warehouse in Canton, Ga., and has branched out into home furniture, medical equipment, and school furniture. Notable clients include the Pentagon, Microsoft, and "American Idol."

Bo Menkiti

Age: 30

Location: Washington, D.C.

2006 Revenue: $640,000

Employees: 10

Year founded: 2004

What it does: A Harvard MBA, Bo Menkiti sold his own home in the capital's Columbia Heights neighborhood to launch an urban real estate development, brokerage, and sales firm aimed at first-time buyers in the underserved middle market. In less than three years, his team has developed 33,000 square feet of residential and commercial property and brokered more than $60 million worth of real estate in the region. What's next for Menkiti? Developing a new 30-unit affordable housing building from the ground up.

Sam Altman

Age: 22

Location: Mountain View, Calif.

2006 Revenue: undisclosed

Employees: 30

Year founded: 2005

What it does: Loopt software provides location-based functions for cell phones, allowing users to see where their friends are on a map. The software also sends text alerts when friends come in close proximity to one another, and can search for nearby restaurants. It'll even tell you what spots your friends have tagged as favorites. Loopt's service is currently available on Boost Mobile, and is expected to launch on Sprint and other carriers within months. Altman says he wants to bring the Internet out of the home and into the wild. "The company's mission is to enhance, improve, and make more of real-world interaction," he says.

Katie Kerrigan

Age: 27

Location: Libertyville, Ill.

2006 Revenue: $57,000

Employees: 1 full-time, 2 part-time

Year founded: 2005

What it does: When Kerrigan, a former college athlete, entered the professional world, she was discouraged by the lack of stylish shoes for tall women. At six-feet tall with a size 11 shoe, she began looking for solutions. While getting her MBA, she drafted a business plan for a company that sold dress shoes to women with larger feet -- sizes 10 and above. In 2005, Kerrigan launched her website, KathrynKerrigan.com, where other women like herself can find everything from stylish high heels to trendy flats. Kerrigan works with a craftsman in Italy to create her original designs. Her shoes can be found in boutiques nationwide and in her new flagship store, which opened this year in Libertyville, Ill. Sales are expected to quadruple this year.

Byron Myers, Ali Perry, and Brenton Taylor

Ages: 27 (Myers), 25 (Perry), and 26 (Taylor)

Location: Goleta, Calif.

2006 Revenue: $15 million

Employees: 100

Year founded: 2001

What it does: Winning a business plan competition at the University of California Santa Barbara prompted these friends to take their idea for an oxygen concentrator and actually form a company. Perry's grandmother complained about the bulkiness and inconvenience of her old oxygen machine, so the trio designed their compact device to filter out the nitrogen from room air, eliminating the hassle of having oxygen tanks delivered. Inogen's machine can also be plugged in anywhere or used on the go with a rechargeable lithium ion battery. The company has sold more than 10,000 devices.

Raj Lahoti

Age: 25

Location: San Diego

2006 Revenue: $11.5 million

Employees: 15

Year founded: 2003

What it does: After a few years dabbling in Internet domain acquisition and traffic brokering, Raj Lahoti set out to build up one of his brother's domains in order to provide meaningful content in an area that, well, generally lacks it. DMV.ORG, the "Online Unofficial Guide to the DMV," aggregates information from the (often dreaded) Department of Motor Vehicles in each state -- all in one place. Users can access information on everything from applying for a license to ordering a driving record, without the aggravation of standing in the DMV's endless lines.

Geoff Cook, Dave Cook, Catherine Cook

Ages: 29 (Geoff), 19 (Dave), and 17 (Catherine)

Location: New Hope, Pa.

2006 Revenue: undisclosed

Employees: 25

Year founded: 2005

What it does: A social networking site for teens, myYearbook.com was hatched around the family dinner table by siblings Catherine and Dave two years ago. With older brother Geoff now on board, the site has since grown from a single high school to more than 3 million members and more than 4.5 million visitors a month, ranking it third among all social networking sites in the United States, behind MySpace and Facebook.

Age: 20

Location: Burlington, Vt.

2006 Revenue: $1 million

Employees: 14

Year founded: 2005

What it does: Mophie makes cases, splitters, arms band, and clips for the iPod. The iPod accessory market may be crowded these days, but Kaufman's goal is to turn Mophie into a community-based product-development company that will solicit ideas for all kinds of new products -- not just iPod add-ons -- from a 50,000 member online user base. He's got $2 million in venture capital and a former top exec from Burton Snowboard on board to help him do it. Revenue is expected to hit $5 million this year.

Sean Belnick

Age: 20

Location: Kennesaw, Ga.

2006 Revenue: $24 million

Employees: 75

Year founded: 2001

What it does: At 14, Sean Belnick started a direct-shipping company for office furniture from his bedroom -- with $500. The company now stocks many of the products it sells in a new 327,000-square-foot warehouse in Canton, Ga., and has branched out into home furniture, medical equipment, and school furniture. Notable clients include the Pentagon, Microsoft, and "American Idol."

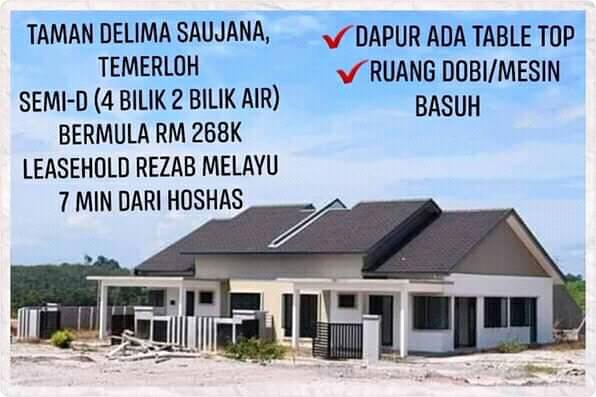

Bo Menkiti

Age: 30

Location: Washington, D.C.

2006 Revenue: $640,000

Employees: 10

Year founded: 2004

What it does: A Harvard MBA, Bo Menkiti sold his own home in the capital's Columbia Heights neighborhood to launch an urban real estate development, brokerage, and sales firm aimed at first-time buyers in the underserved middle market. In less than three years, his team has developed 33,000 square feet of residential and commercial property and brokered more than $60 million worth of real estate in the region. What's next for Menkiti? Developing a new 30-unit affordable housing building from the ground up.

Sam Altman

Age: 22

Location: Mountain View, Calif.

2006 Revenue: undisclosed

Employees: 30

Year founded: 2005

What it does: Loopt software provides location-based functions for cell phones, allowing users to see where their friends are on a map. The software also sends text alerts when friends come in close proximity to one another, and can search for nearby restaurants. It'll even tell you what spots your friends have tagged as favorites. Loopt's service is currently available on Boost Mobile, and is expected to launch on Sprint and other carriers within months. Altman says he wants to bring the Internet out of the home and into the wild. "The company's mission is to enhance, improve, and make more of real-world interaction," he says.

Katie Kerrigan

Age: 27

Location: Libertyville, Ill.

2006 Revenue: $57,000

Employees: 1 full-time, 2 part-time

Year founded: 2005

What it does: When Kerrigan, a former college athlete, entered the professional world, she was discouraged by the lack of stylish shoes for tall women. At six-feet tall with a size 11 shoe, she began looking for solutions. While getting her MBA, she drafted a business plan for a company that sold dress shoes to women with larger feet -- sizes 10 and above. In 2005, Kerrigan launched her website, KathrynKerrigan.com, where other women like herself can find everything from stylish high heels to trendy flats. Kerrigan works with a craftsman in Italy to create her original designs. Her shoes can be found in boutiques nationwide and in her new flagship store, which opened this year in Libertyville, Ill. Sales are expected to quadruple this year.

Byron Myers, Ali Perry, and Brenton Taylor

Ages: 27 (Myers), 25 (Perry), and 26 (Taylor)

Location: Goleta, Calif.

2006 Revenue: $15 million

Employees: 100

Year founded: 2001

What it does: Winning a business plan competition at the University of California Santa Barbara prompted these friends to take their idea for an oxygen concentrator and actually form a company. Perry's grandmother complained about the bulkiness and inconvenience of her old oxygen machine, so the trio designed their compact device to filter out the nitrogen from room air, eliminating the hassle of having oxygen tanks delivered. Inogen's machine can also be plugged in anywhere or used on the go with a rechargeable lithium ion battery. The company has sold more than 10,000 devices.

Raj Lahoti

Age: 25

Location: San Diego

2006 Revenue: $11.5 million

Employees: 15

Year founded: 2003

What it does: After a few years dabbling in Internet domain acquisition and traffic brokering, Raj Lahoti set out to build up one of his brother's domains in order to provide meaningful content in an area that, well, generally lacks it. DMV.ORG, the "Online Unofficial Guide to the DMV," aggregates information from the (often dreaded) Department of Motor Vehicles in each state -- all in one place. Users can access information on everything from applying for a license to ordering a driving record, without the aggravation of standing in the DMV's endless lines.

Geoff Cook, Dave Cook, Catherine Cook

Ages: 29 (Geoff), 19 (Dave), and 17 (Catherine)

Location: New Hope, Pa.

2006 Revenue: undisclosed

Employees: 25

Year founded: 2005

What it does: A social networking site for teens, myYearbook.com was hatched around the family dinner table by siblings Catherine and Dave two years ago. With older brother Geoff now on board, the site has since grown from a single high school to more than 3 million members and more than 4.5 million visitors a month, ranking it third among all social networking sites in the United States, behind MySpace and Facebook.

Monday, July 23, 2007

MOTIVATION TO IMPROVE YOUR FINANCES

One of the most difficult aspects of getting your finances in order is finding the motivation to do so.

Here are some basic steps you can take to help motivate yourself to move from merely thinking about improving your finances to actually taking action to improve them.

WRITE A LIST

While this may seem obvious, it's often the hardest step to take. Thinking about all of the different tasks you need to do can paralyze you into doing nothing at all. If you can write down all of the things you need to do, then you have a list from which to begin tackling the tasks, and it will become easier to motivate yourself to work toward them.

SET FINANCIAL GOALS

Once you have made your list of the financial tasks you need to accomplish, spend some time turning these into financial goals. One of the most important points when setting goals is to make them specific and to place a time limit on them. For example, "I want to have $25,000 in my retirement account within five years" is a much better goal than "I want to fund my retirement account." The more specific you can be with your goals, the easier it will be to take the steps needed to achieve them and to monitor and record your progress.

CREATE CONCRETE & PERSONAL REASONS

One of the most powerful forces that will help you achieve your goals is to have concrete and personal reasons why those goals are important to you. The more solid and exclusive the reasons you can list for each goal, the more motivated and dedicated you will be to achieving them. "I want to fulfill my dream to travel to Europe before I'm 65" is a more concrete and personal reason to want to save for retirement than "my financial adviser says it's important."

CREATE MINI GOALS

Once you have your goals in place, take some time to break them down into smaller, mini goals. Many financial goals are long -term ones. They can often be so big and so far off in the future that when looking only at your desired final result, you'll have no idea where to even begin. By breaking down your goals into smaller ones, it will be much easier to visualize each step that you need to take.

KEEP A DAILY FINANCIAL JOURNAL

A wonderful way to help yourself stay motivated and move toward your financial goals is to begin a daily financial journal. You can write this journal the old-fashioned way, by hand, or you can create one online and join the many personal finance bloggers who keep track of their finances for the world to see. Keeping a daily journal will help you stay focused on your money goals, offer a daily reminder of where you want your finances to be in the future and allow you to see your progress as you strive for those goals. When you get frustrated or discouraged, going back and reviewing the progress you have made will be invaluable to helping you stay motivated.

DON'T KEEP IT A SECRET & INVOLVE THE ENTIRE FAMILY

While you may be tempted to keep your financial goals a secret, you will be much better off if you let others know what they are. It is much harder to back out or give up on your financial goals when you create a sort of personal accountability by announcing them to others. Letting others in on your goals also creates a support network that can help motivate and encourage you when times get hard. For those with families, involving the entire household in your financial goals works in your interest. You will have a much better chance of completing your goals as a team than if you try to accomplish them entirely by yourself. The more people you involve, the more ideas you will have on how to reach those goals. In addition, the undertaking could prove to be a financial learning experience for the entire family instead of just a one-person odyssey. If you fail to involve family members, they could inadvertently sabotage your efforts to reach your financial goals, and they may not understand why certain monetary sacrifices are being made. Taking the time to include everyone and seeking their help, advice and ideas will greatly increase your chances of success.

KEEP YOUR GOALS VISIBLE

Whatever your financial goals may be, make sure to place them prominently someplace in your house where you are sure to see them more than once a day. Many times people write down their goals and then file them away, never to be seen again. When this happens, the goals are usually forgotten in a short period of time. Placing your goals in a prominent area of your house will help ensure that they don't slip your mind. For example, you may want to place them on your refrigerator door, above your computer or on the backside of the door you use to exit your house. The more often you see them, the better chance you have of staying focused and motivated to reach your goals.

CHART YOUR PROGRESS

Make sure that you take the time at least once a month to chart your progress toward your goals. If you are writing a daily journal, it should be easy to look over your entries and come up with a summary for the entire month. Charting your progress over a longer period will show you that the daily steps you take are adding up over time.

JOIN FINANCIAL COMMUNITIES

A wide variety of Web sites cater to those who are trying to get their finances in order. Spending time in the forums, reading articles and sharing your own financial issues will help you gain valuable information on attaining your goals. These communities will also be a great help to keep you motivated when you're having trouble or when you're faced with unexpected financial setbacks.

BE PATIENT

You need to remember that everything is not going to change overnight, and that it's going to take a long time at a steady pace to reach your financial goals. Many people give up when they believe that the changes they want aren't happening quickly enough. If you realize that doing a little bit every day will ultimately help you reach your goals, you will not be discouraged and quit when things don't change rapidly.

REWARD YOURSELF

Take the time to reward yourself as you reach milestones on your way to your financial goals. Giving yourself rewards is important to help keep you motivated and can help get you through some of the harder times. Your reward can be anything that helps motivate you to reach the goal. For example, a night out for ice cream, a pizza dinner or a trip to the movies ……… anything that your family enjoys doing together to reward everyone for helping to make progress toward your goals.

BE PREPARED FOR SETBACKS

Understand that no matter how good you are and how well you have planned out everything, there will be times when unexpected setbacks occur. By understanding that these setbacks will come about, you can make sure that you have in place support mechanisms that will help you overcome these obstacles and stay on track toward your goals. It is when these unexpected setbacks occur that being part of a financial community and writing your daily diary will really pay off. By understanding that these events will arise, you will be able to recognize them when they do and have a much better chance of not succumbing to the temptation to give up. By taking each of these steps into consideration, you increase the chances that you will have the focus to stay motivated and to reach all of your financial goals.

JOIN THE "SMART PARTNERSHIP PROGRAM"

The easiest way to improve your financial status is by joining a "Smart Partnership Program" just like I'm doing. The tips is "Let Your Money Works For You". If you are interested just send email to me and I'll share it with you.

Here are some basic steps you can take to help motivate yourself to move from merely thinking about improving your finances to actually taking action to improve them.

WRITE A LIST

While this may seem obvious, it's often the hardest step to take. Thinking about all of the different tasks you need to do can paralyze you into doing nothing at all. If you can write down all of the things you need to do, then you have a list from which to begin tackling the tasks, and it will become easier to motivate yourself to work toward them.

SET FINANCIAL GOALS

Once you have made your list of the financial tasks you need to accomplish, spend some time turning these into financial goals. One of the most important points when setting goals is to make them specific and to place a time limit on them. For example, "I want to have $25,000 in my retirement account within five years" is a much better goal than "I want to fund my retirement account." The more specific you can be with your goals, the easier it will be to take the steps needed to achieve them and to monitor and record your progress.

CREATE CONCRETE & PERSONAL REASONS

One of the most powerful forces that will help you achieve your goals is to have concrete and personal reasons why those goals are important to you. The more solid and exclusive the reasons you can list for each goal, the more motivated and dedicated you will be to achieving them. "I want to fulfill my dream to travel to Europe before I'm 65" is a more concrete and personal reason to want to save for retirement than "my financial adviser says it's important."

CREATE MINI GOALS

Once you have your goals in place, take some time to break them down into smaller, mini goals. Many financial goals are long -term ones. They can often be so big and so far off in the future that when looking only at your desired final result, you'll have no idea where to even begin. By breaking down your goals into smaller ones, it will be much easier to visualize each step that you need to take.

KEEP A DAILY FINANCIAL JOURNAL

A wonderful way to help yourself stay motivated and move toward your financial goals is to begin a daily financial journal. You can write this journal the old-fashioned way, by hand, or you can create one online and join the many personal finance bloggers who keep track of their finances for the world to see. Keeping a daily journal will help you stay focused on your money goals, offer a daily reminder of where you want your finances to be in the future and allow you to see your progress as you strive for those goals. When you get frustrated or discouraged, going back and reviewing the progress you have made will be invaluable to helping you stay motivated.

DON'T KEEP IT A SECRET & INVOLVE THE ENTIRE FAMILY

While you may be tempted to keep your financial goals a secret, you will be much better off if you let others know what they are. It is much harder to back out or give up on your financial goals when you create a sort of personal accountability by announcing them to others. Letting others in on your goals also creates a support network that can help motivate and encourage you when times get hard. For those with families, involving the entire household in your financial goals works in your interest. You will have a much better chance of completing your goals as a team than if you try to accomplish them entirely by yourself. The more people you involve, the more ideas you will have on how to reach those goals. In addition, the undertaking could prove to be a financial learning experience for the entire family instead of just a one-person odyssey. If you fail to involve family members, they could inadvertently sabotage your efforts to reach your financial goals, and they may not understand why certain monetary sacrifices are being made. Taking the time to include everyone and seeking their help, advice and ideas will greatly increase your chances of success.

KEEP YOUR GOALS VISIBLE

Whatever your financial goals may be, make sure to place them prominently someplace in your house where you are sure to see them more than once a day. Many times people write down their goals and then file them away, never to be seen again. When this happens, the goals are usually forgotten in a short period of time. Placing your goals in a prominent area of your house will help ensure that they don't slip your mind. For example, you may want to place them on your refrigerator door, above your computer or on the backside of the door you use to exit your house. The more often you see them, the better chance you have of staying focused and motivated to reach your goals.

CHART YOUR PROGRESS

Make sure that you take the time at least once a month to chart your progress toward your goals. If you are writing a daily journal, it should be easy to look over your entries and come up with a summary for the entire month. Charting your progress over a longer period will show you that the daily steps you take are adding up over time.

JOIN FINANCIAL COMMUNITIES

A wide variety of Web sites cater to those who are trying to get their finances in order. Spending time in the forums, reading articles and sharing your own financial issues will help you gain valuable information on attaining your goals. These communities will also be a great help to keep you motivated when you're having trouble or when you're faced with unexpected financial setbacks.

BE PATIENT

You need to remember that everything is not going to change overnight, and that it's going to take a long time at a steady pace to reach your financial goals. Many people give up when they believe that the changes they want aren't happening quickly enough. If you realize that doing a little bit every day will ultimately help you reach your goals, you will not be discouraged and quit when things don't change rapidly.

REWARD YOURSELF

Take the time to reward yourself as you reach milestones on your way to your financial goals. Giving yourself rewards is important to help keep you motivated and can help get you through some of the harder times. Your reward can be anything that helps motivate you to reach the goal. For example, a night out for ice cream, a pizza dinner or a trip to the movies ……… anything that your family enjoys doing together to reward everyone for helping to make progress toward your goals.

BE PREPARED FOR SETBACKS

Understand that no matter how good you are and how well you have planned out everything, there will be times when unexpected setbacks occur. By understanding that these setbacks will come about, you can make sure that you have in place support mechanisms that will help you overcome these obstacles and stay on track toward your goals. It is when these unexpected setbacks occur that being part of a financial community and writing your daily diary will really pay off. By understanding that these events will arise, you will be able to recognize them when they do and have a much better chance of not succumbing to the temptation to give up. By taking each of these steps into consideration, you increase the chances that you will have the focus to stay motivated and to reach all of your financial goals.

JOIN THE "SMART PARTNERSHIP PROGRAM"

The easiest way to improve your financial status is by joining a "Smart Partnership Program" just like I'm doing. The tips is "Let Your Money Works For You". If you are interested just send email to me and I'll share it with you.

Wednesday, July 18, 2007

TIPS - MONEY MAKING FUNDAMENTALS

At the core of every successful business, from a global giant to a corner store, are the same fundamentals of money making , which are cash, margin, velocity, return, and growth.

And at the core of every successful business leader is an intuitive understanding of the relationships among them.

It's easy to think the basics of business are for beginners. Everyone knows what cash is, and that companies must make a profit.

But business acumen isn't about knowing definitions. It's about keeping the basics of money making in sharp focus and balancing them in a way that's healthy for the business.

When you have business acumen, you realize the importance of every job at every stage of your career. A mailroom clerk with business acumen knows that getting checks to the accounts receivable department more quickly will ease the company's cash flow. And a sales rep with business acumen knows that higher-margin products will increase the company's return.

Money making Basics

As the complexity of your job increases, it's easy to lose sight of the fundamentals. If your business acumen doesn't develop, you can stumble - focus too much on revenue growth and overlook cash, or focus too much on cash and overlook growth.

That's why you should never consider it beneath you to revisit the money making basics. They should be front and center in your diagnosis and decision making in every job you have.

Here are the basics :

CASH

No business survives long without it. You should know how much cash your business generates and how much cash it consumes.

What are the sources of it ? What drains it ? What's the timing of the inflows and outflows and how is it changing ? More sales often means more cash. But growing a business consumes cash. How fast can the company expand without straining its cash flow ?

MARGIN

When people talk about the bottom line, they generally mean net profit margin. The money the company earns after paying all its expenses, interest, and taxes. But gross margin is important, too. Gross margin is the difference between a product's selling price and what it costs to make the product , expressed as a percent of the selling price which can signal important shifts in a business. When PC makers saw their 32 percent gross margins decline to 20, they knew the competitive landscape had changed. You have to know how changes inside or outside the business affect gross margin. Are there new entrants in the market who are winning customers? A competitor who's found a clever way to reduce costs and prices? A change in the pricing power of suppliers?

VELOCITY

Velocity refers to speed, turnover, or movement. How much revenue do you turn over, or generate, for each dollar of inventory? If you have $1 million in inventory for the year and revenues of $10 million, your inventory velocity is 10. This tells you how fast you're moving raw materials through the factory, turning them into finished products, and moving those products off the shelf to customers. The faster, the better. Service businesses can track velocity, too. For banks, velocity of equity . How much revenue is generated per dollar of equity ….. is a useful measure. The concept applies to every business.

RETURN

Margin multiplied by velocity equals return. If your return is lower than your cost of capital, your business is likely to be in trouble. That's when shareholders get concerned. How do you boost your return? See if you can boost your margin or increase your velocity ……. or, better yet, both.

GROWTH

Every business needs to grow to stay in business. How do you grow in a way that keeps the other aspects of money making in balance? There's no formula …. people with business acumen figure it out.

Where Business Acumen Counts Most

Street vendors in villages around the world use business acumen every day. They have to. Their next meal often depends on it.

In companies, business acumen is crucial when the external world changes and there's a need to reposition the business.

Like when Hollywood studios started selling videocassettes directly to the public at the same time it sold them to video rental companies. That's when Blockbuster's rental business started to slide.

People wanted to buy movies, not just rent them, so Blockbuster started selling them. But the moneymaking was completely different.

Blockbuster was used to buying videocassettes on credit and making payments with the cash from renting them. Returns were high.

Selling videocassettes meant laying out the cash up front, holding lots of inventory, and waiting for the cash to come in when the videocassettes were sold. Cash flow, velocity, and return were all adversely affected.

Where Do You Want to Go?

You don't need business acumen to make a meaningful contribution to a business. But you'll need it to rise through the leadership ranks.

You can't acquire it at a seminar or in a quick read. You learn it by using it in real business situations.

Start now by applying it to your company. Ask for the numbers or pull them from the annual report.

And at the core of every successful business leader is an intuitive understanding of the relationships among them.

It's easy to think the basics of business are for beginners. Everyone knows what cash is, and that companies must make a profit.

But business acumen isn't about knowing definitions. It's about keeping the basics of money making in sharp focus and balancing them in a way that's healthy for the business.

When you have business acumen, you realize the importance of every job at every stage of your career. A mailroom clerk with business acumen knows that getting checks to the accounts receivable department more quickly will ease the company's cash flow. And a sales rep with business acumen knows that higher-margin products will increase the company's return.

Money making Basics

As the complexity of your job increases, it's easy to lose sight of the fundamentals. If your business acumen doesn't develop, you can stumble - focus too much on revenue growth and overlook cash, or focus too much on cash and overlook growth.

That's why you should never consider it beneath you to revisit the money making basics. They should be front and center in your diagnosis and decision making in every job you have.

Here are the basics :

CASH

No business survives long without it. You should know how much cash your business generates and how much cash it consumes.

What are the sources of it ? What drains it ? What's the timing of the inflows and outflows and how is it changing ? More sales often means more cash. But growing a business consumes cash. How fast can the company expand without straining its cash flow ?

MARGIN

When people talk about the bottom line, they generally mean net profit margin. The money the company earns after paying all its expenses, interest, and taxes. But gross margin is important, too. Gross margin is the difference between a product's selling price and what it costs to make the product , expressed as a percent of the selling price which can signal important shifts in a business. When PC makers saw their 32 percent gross margins decline to 20, they knew the competitive landscape had changed. You have to know how changes inside or outside the business affect gross margin. Are there new entrants in the market who are winning customers? A competitor who's found a clever way to reduce costs and prices? A change in the pricing power of suppliers?

VELOCITY

Velocity refers to speed, turnover, or movement. How much revenue do you turn over, or generate, for each dollar of inventory? If you have $1 million in inventory for the year and revenues of $10 million, your inventory velocity is 10. This tells you how fast you're moving raw materials through the factory, turning them into finished products, and moving those products off the shelf to customers. The faster, the better. Service businesses can track velocity, too. For banks, velocity of equity . How much revenue is generated per dollar of equity ….. is a useful measure. The concept applies to every business.

RETURN

Margin multiplied by velocity equals return. If your return is lower than your cost of capital, your business is likely to be in trouble. That's when shareholders get concerned. How do you boost your return? See if you can boost your margin or increase your velocity ……. or, better yet, both.

GROWTH

Every business needs to grow to stay in business. How do you grow in a way that keeps the other aspects of money making in balance? There's no formula …. people with business acumen figure it out.

Where Business Acumen Counts Most

Street vendors in villages around the world use business acumen every day. They have to. Their next meal often depends on it.

In companies, business acumen is crucial when the external world changes and there's a need to reposition the business.

Like when Hollywood studios started selling videocassettes directly to the public at the same time it sold them to video rental companies. That's when Blockbuster's rental business started to slide.

People wanted to buy movies, not just rent them, so Blockbuster started selling them. But the moneymaking was completely different.

Blockbuster was used to buying videocassettes on credit and making payments with the cash from renting them. Returns were high.

Selling videocassettes meant laying out the cash up front, holding lots of inventory, and waiting for the cash to come in when the videocassettes were sold. Cash flow, velocity, and return were all adversely affected.

Where Do You Want to Go?

You don't need business acumen to make a meaningful contribution to a business. But you'll need it to rise through the leadership ranks.

You can't acquire it at a seminar or in a quick read. You learn it by using it in real business situations.

Start now by applying it to your company. Ask for the numbers or pull them from the annual report.

Tuesday, July 10, 2007

TIPS - THINK BIG , SPEND SMALL

START & GROW A SUCCESSFUL COMPANY WITH LIMITED BUDGET

CASE 1

John Vechey, 28, proudly recalls the early penny-pinching days of his Seattle gaming company, PopCap Games, which he co-founded with partners Brian Fiete, 29, and Jason Kapalka, 36, in 2000. After leaving their steady jobs at gaming companies, the trio pooled $100 to purchase business cards, used their own computers and convinced a friend who owned an ISP to give them server space for free. Working first from Fiete's condo, then from Vechey's apartment, they started with a simple business model ….. to make games and license them to websites.

Then the ad market crashed, rendering their model insufficient and teaching the partners the first lesson of bootstrap entrepreneurs …… flexibility. In 2001, based on feedback on their first game, Bejeweled, they created an enhanced, downloadable version. Instead of charging sites like Yahoo to host their games, they offer the web versions for free in exchange for having the sites direct people to PopCap's site to download full versions of the games. "At first, we were making $5,000 to $10,000 per month. Then it was $30,000 to $100,000," Vechey recalls.

Vechey and his team raked in more than $10 million in 2005, and they now have 13,000 square feet of office space in downtown Seattle, a studio in San Francisco and a satellite office in Dublin, Ireland. They employ 118 people and have more than 30 different games.

CASE 2

After selling her first company in 2000, Amy James, the former teacher negotiated the right to retain a database of state learning standards that she had spent two years typing into a Microsoft Access file. In 2001, James decided to take advantage of that year's No Child Left Behind Act and put her database to work. "I made a flier saying I could align curriculum with learning standards and faxed it to publishers," she says. "Scholastic called immediately. Then LeapFrog. Then others."

For the cost of office supplies--about $100--James was in business, launching SixThings from her New York City apartment. She made $30,000 her first year, consulting with publishers, reviewing educational programs and curricula, and writing reports analyzing how these measured up to state and federal learning and testing requirements. James ramped up significantly in her second year, hiring two curriculum development employees and one computer programmer. In addition to analysis, the company now sells electronic databases of learning and testing requirements and licenses software that provides compliance reporting along state and federal guidelines.

But James was struggling to pay her rent and knew something had to give. Her mother was a retired teacher back in her hometown near Oklahoma City, and James could tap her mom's friends as workers. So she moved into the same apartment complex as her mother.

"It just made sense," says James, 40. "My mom's friends were starting to retire. My dad was a principal. They were all on state benefits and had a great work ethic." With her mother as her first Oklahoma employee and her father as a sounding board, she began to rebuild her business.

James used open source software and worked from home for the first three years of business, finally moving into a 6,000-square-foot Oklahoma City office space in 2004. She furnished that space, including the refrigerator, she says proudly, for a mere $1,900 by visiting vacated offices and offering cash for the abandoned furniture. She continues to pinch pennies, even after bringing in sales of more than $2.1 million last year. Of her 20 full-time and 43 part-time employees, the vast majority are her parents' retired friends. She has also re-established an office in New York City.

CASE 3

Ajay Goel, 29, was living with his parents in 2000 when he created the first version of JangoMail as a side project for a client who needed a web-based e-mail marketing solution. Because he had a computer and no overhead, Goel was able to fine-tune the product, then take it to market. JangoMail, with its web-based e-mail broadcasting and marketing system that allows companies to create, send and track e-mail campaigns, projects sales of $5 million for 2007. While the four-person company works virtually, Goel invested in 900 square feet of office space in Dayton, Ohio, to give the company a home base and employees a place to work when they come to town.

JangoMail has grown mostly through referrals, networking and search engine advertising, landing clients like the American Cancer Society and Nokia. Instead of expanding through additional products or line extensions, JangoMail remains the company's sole offering, available through its website. Goel is constantly tinkering and adding features. "I wanted to operate with a salesperson-less model," he says. "We are there if [customers] need us, but they can buy the product on their own."

CASE 4

A little help from friends allowed Maureen and Jeff Kendall to launch their San Jose, California, T-shirt company, Little Ruler, with about $1,000 for their first run of 100 T-shirts. Jeff, 39, was a well-known figure in the skateboarding world when the couple had their first son, Cole, in 2001. They received tiny T-shirts individually screened with skateboard industry logos as gifts. Seeing people's reactions to the shirts inspired them to launch their own line of children's clothing featuring logos licensed from hot skateboard companies. As word got out about their idea, friends offered to help design the T-shirts and their website for free, saving the couple big bucks on some basic startup needs.

CASE 1

John Vechey, 28, proudly recalls the early penny-pinching days of his Seattle gaming company, PopCap Games, which he co-founded with partners Brian Fiete, 29, and Jason Kapalka, 36, in 2000. After leaving their steady jobs at gaming companies, the trio pooled $100 to purchase business cards, used their own computers and convinced a friend who owned an ISP to give them server space for free. Working first from Fiete's condo, then from Vechey's apartment, they started with a simple business model ….. to make games and license them to websites.

Then the ad market crashed, rendering their model insufficient and teaching the partners the first lesson of bootstrap entrepreneurs …… flexibility. In 2001, based on feedback on their first game, Bejeweled, they created an enhanced, downloadable version. Instead of charging sites like Yahoo to host their games, they offer the web versions for free in exchange for having the sites direct people to PopCap's site to download full versions of the games. "At first, we were making $5,000 to $10,000 per month. Then it was $30,000 to $100,000," Vechey recalls.

Vechey and his team raked in more than $10 million in 2005, and they now have 13,000 square feet of office space in downtown Seattle, a studio in San Francisco and a satellite office in Dublin, Ireland. They employ 118 people and have more than 30 different games.

CASE 2

After selling her first company in 2000, Amy James, the former teacher negotiated the right to retain a database of state learning standards that she had spent two years typing into a Microsoft Access file. In 2001, James decided to take advantage of that year's No Child Left Behind Act and put her database to work. "I made a flier saying I could align curriculum with learning standards and faxed it to publishers," she says. "Scholastic called immediately. Then LeapFrog. Then others."

For the cost of office supplies--about $100--James was in business, launching SixThings from her New York City apartment. She made $30,000 her first year, consulting with publishers, reviewing educational programs and curricula, and writing reports analyzing how these measured up to state and federal learning and testing requirements. James ramped up significantly in her second year, hiring two curriculum development employees and one computer programmer. In addition to analysis, the company now sells electronic databases of learning and testing requirements and licenses software that provides compliance reporting along state and federal guidelines.

But James was struggling to pay her rent and knew something had to give. Her mother was a retired teacher back in her hometown near Oklahoma City, and James could tap her mom's friends as workers. So she moved into the same apartment complex as her mother.

"It just made sense," says James, 40. "My mom's friends were starting to retire. My dad was a principal. They were all on state benefits and had a great work ethic." With her mother as her first Oklahoma employee and her father as a sounding board, she began to rebuild her business.

James used open source software and worked from home for the first three years of business, finally moving into a 6,000-square-foot Oklahoma City office space in 2004. She furnished that space, including the refrigerator, she says proudly, for a mere $1,900 by visiting vacated offices and offering cash for the abandoned furniture. She continues to pinch pennies, even after bringing in sales of more than $2.1 million last year. Of her 20 full-time and 43 part-time employees, the vast majority are her parents' retired friends. She has also re-established an office in New York City.

CASE 3

Ajay Goel, 29, was living with his parents in 2000 when he created the first version of JangoMail as a side project for a client who needed a web-based e-mail marketing solution. Because he had a computer and no overhead, Goel was able to fine-tune the product, then take it to market. JangoMail, with its web-based e-mail broadcasting and marketing system that allows companies to create, send and track e-mail campaigns, projects sales of $5 million for 2007. While the four-person company works virtually, Goel invested in 900 square feet of office space in Dayton, Ohio, to give the company a home base and employees a place to work when they come to town.

JangoMail has grown mostly through referrals, networking and search engine advertising, landing clients like the American Cancer Society and Nokia. Instead of expanding through additional products or line extensions, JangoMail remains the company's sole offering, available through its website. Goel is constantly tinkering and adding features. "I wanted to operate with a salesperson-less model," he says. "We are there if [customers] need us, but they can buy the product on their own."

CASE 4

A little help from friends allowed Maureen and Jeff Kendall to launch their San Jose, California, T-shirt company, Little Ruler, with about $1,000 for their first run of 100 T-shirts. Jeff, 39, was a well-known figure in the skateboarding world when the couple had their first son, Cole, in 2001. They received tiny T-shirts individually screened with skateboard industry logos as gifts. Seeing people's reactions to the shirts inspired them to launch their own line of children's clothing featuring logos licensed from hot skateboard companies. As word got out about their idea, friends offered to help design the T-shirts and their website for free, saving the couple big bucks on some basic startup needs.

Friday, July 6, 2007

JOIN CASH88

GET Financial freedom within your reach through cash88.com

* Do you want to be financially free?

* Do you want to end your money worries ?

* Do you want to add an extra income from now to the future?

If your answer is yes, then let me show you how you can begin LIVING YOUR DREAMS THIS YEAR. I shall get straight to the point.

I have discovered the perfect part time business. It is not real estate, it is not selling cars but it is just as powerful. It is a $$ business. It takes little time & no risk at all. It is so simple, you get paid by clicking advertisements, anyone can do it.

You could be earning an extra stream of income in as fast as 60 days from the day you get started. Even after you do not do very much in future but as long as your down levels are performing, you will still be receiving income from their efforts.

I know this sound absurd & too good to be true. Frankly, I was also very skeptical myself at first. Finally, I agreed to check it out. I am on the way to earn $$$ commission - no gimmicks.

Would you like to learn how to do that?

No obligation, if after you listen to the plan & you are still not interested. Anyway, there is no harm knowing more about this creative business.

I am starting to get excited about the potential of this cash88.com business and trying to have a team of committed people who are serious about their financial future. If you are interested to know or join our cash 88.com business venture, CLICK BELOW …..

http://www.cash88.com/pages/index.php?refid=nazrism

* Do you want to be financially free?

* Do you want to end your money worries ?

* Do you want to add an extra income from now to the future?

If your answer is yes, then let me show you how you can begin LIVING YOUR DREAMS THIS YEAR. I shall get straight to the point.

I have discovered the perfect part time business. It is not real estate, it is not selling cars but it is just as powerful. It is a $$ business. It takes little time & no risk at all. It is so simple, you get paid by clicking advertisements, anyone can do it.

You could be earning an extra stream of income in as fast as 60 days from the day you get started. Even after you do not do very much in future but as long as your down levels are performing, you will still be receiving income from their efforts.

I know this sound absurd & too good to be true. Frankly, I was also very skeptical myself at first. Finally, I agreed to check it out. I am on the way to earn $$$ commission - no gimmicks.

Would you like to learn how to do that?

No obligation, if after you listen to the plan & you are still not interested. Anyway, there is no harm knowing more about this creative business.

I am starting to get excited about the potential of this cash88.com business and trying to have a team of committed people who are serious about their financial future. If you are interested to know or join our cash 88.com business venture, CLICK BELOW …..

http://www.cash88.com/pages/index.php?refid=nazrism

Sunday, July 1, 2007

TIPS - SEARCH THE NET AND EARN MONEY

Join the Search 'N' Earn Program and Earn Money !

Earn money by setting slashmysearch as your homepage.

Earn more money by using it as your primary search engine.

The more you search the more you make, it's that … simple !

Use SlashMySearch as your primary search engine and earn money !

All pages and features on SlashMySearch count towards your activity.

Sign up now for free and earn money every day !

We make money from advertising and we share it with you.

You will benefit 3 levels of commissions !

Refer other people and earn even more money.

Income potential of $180 per month while doing what you normally do on the internet. This is with never referring anyone.

Earnings could increase to $500 or more per month when you refer other people. Search the web, shop and use unique features of SlashMySearch while you make money !

Instead of purchasing advertising, we choose to reward you for using SlashMySearch.

Only a minimum balance (earnings) of $20 to get paid !

You will not be spammed and only receive up to 2 advertisements by email per month.

We also donate a percentage of our income every month to charity.

You get to give and get while you do something you already do !

This does not come from your earnings.

100% free to join and be a member!

JOIN NOW FOR FREE. CLICK THIS TO JOIN……. SlashMysearch

Earn money by setting slashmysearch as your homepage.

Earn more money by using it as your primary search engine.

The more you search the more you make, it's that … simple !

Use SlashMySearch as your primary search engine and earn money !

All pages and features on SlashMySearch count towards your activity.

Sign up now for free and earn money every day !

We make money from advertising and we share it with you.

You will benefit 3 levels of commissions !

Refer other people and earn even more money.

Income potential of $180 per month while doing what you normally do on the internet. This is with never referring anyone.

Earnings could increase to $500 or more per month when you refer other people. Search the web, shop and use unique features of SlashMySearch while you make money !

Instead of purchasing advertising, we choose to reward you for using SlashMySearch.

Only a minimum balance (earnings) of $20 to get paid !

You will not be spammed and only receive up to 2 advertisements by email per month.

We also donate a percentage of our income every month to charity.

You get to give and get while you do something you already do !

This does not come from your earnings.

100% free to join and be a member!

JOIN NOW FOR FREE. CLICK THIS TO JOIN……. SlashMysearch

Subscribe to:

Posts (Atom)